is there real estate transfer tax in florida

For example the Save Our Homes assessment limitation caps increases in assessments for property taxes at 3 annually. New York 2000.

How To Calculate Land Transfer Tax Mortgage Math 6 With Ratehub Ca Youtube

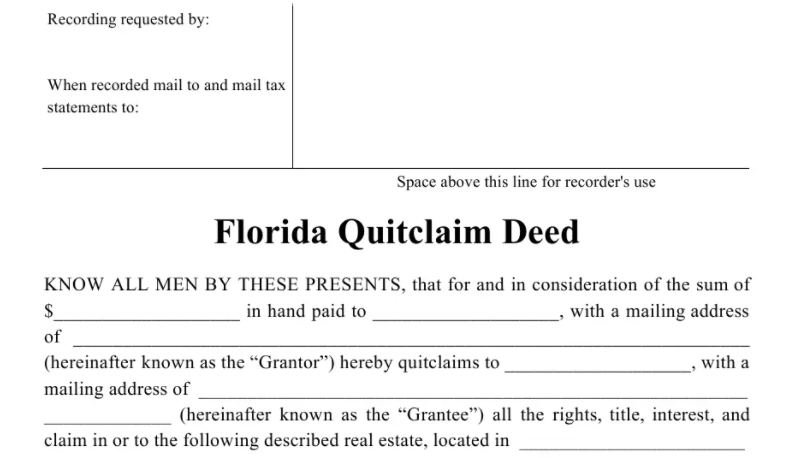

There is a small fee for filing and a document stamp tax which is an excise tax on legal documents delivered executed or recorded in the state.

. Its what you do for closing. Secondly how much is deed tax in Florida. Outside of Miami-Dade County.

PDF 106 KB. Outside of Miami-Dade County the transfer tax rate is 70 cents per 100 of the deeds consideration. Transfer Tax in Florida.

When real estate changes hands oftentimes state and local governments charge a transfer tax. Call The Law Office Of Richard S. Floridas transfer tax falls under the.

A person filing a deed for transfer of Florida real estate ownership must do so through the county comptrollers office where the property is located. There is a zero NYS transfer tax. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021. The amount of tax due is computed based on the consideration for the transfer. Its based on the propertys sale price and is paid by the buyer seller or both parties upon transfer of real property.

Florida transfer taxes are the same in every county with the exception of Miami-Dade. However your trust needs to have language that preserves homestead rights or you could lose your homestead exemption. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed.

Florida documentary stamp taxes use a calculation process. On any amount above 400000 you would have to pay the full 2. In Florida there is no state income tax as there is in other US states.

The tax is called documentary stamp tax and is an excise tax on the deed or other instrument transferring the interest in real property. In Florida transfer tax is called a documentary stamp tax. This fee is charged by the recording offices in most counties.

This tax may be greater if there is a lien on the. Real estate transfer taxes can be charged at the state city andor county levels depending on where you live. 350000 200000 150000 in Tax Benefit.

Also called the real estate transfer tax. I say florida has no state income tax so they make up for it with real estate taxes and speeding tickets. The transfer is not taxable in and of itself nor subject to transfer taxes.

Transfer tax referred to as documentary stamp tax in Florida is a tax imposed by states counties and cities on the transfer of the title of real property from one person or entity to another within the jurisdiction. Sales and Use Tax. Many states impose some type of tax on property transfers.

Proper estate planning can lower the value of an estate such that no or minimal taxes are owed. North Carolina 1000. To make it simple imagine a condo in Lee County that sells for 100000.

Florida is no exception. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. You will have to pay a small recording fee and minimal document stamps.

Transfer TaxDocumentary Stamp Taxes. Real Property Dedicated in Perpetuity for Conservation Exemption Application R. Florida calls its tax the documentary stamp tax.

Every state has a transfer tax of some sort which is essentially a fee the state charges to transfer a property from one party to the other. Floridas equivalent to the transfer tax is the documentary stamp. Real Estate- Transfer taxes are negotiable in the contract but in most states the seller pays the tax if.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. In some areas real estate transfer tax is considered a fee for processing the transfer paperwork even though you dont need to pay 1000 or 2000 to put a stamp on the property Fallico says. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home.

This tax is also referred to as an excise tax. In Florida transfer tax is called a documentary stamp tax. Here we discuss the taxes related to owning real estate in Florida and their implications for both resident and global buyers.

Property Tax Exemptions and Additional Benefits. Overview of Florida Taxes. There is no inheritance tax or estate tax in Florida.

Its what you do for closing. Every county in Florida has a. You sell your current Florida Homestead that has an Assessed Value of 200000 and a Just Market Value of 350000.

Total Price100 x 70 Doc Stamps Cost. For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes. There is also an annual property tax on any.

The amount of. There is no inheritance tax or estate tax in Florida. Which is the act of placing a value on a piece of real estate.

Deeds and other documents that transfer an interest in Florida real property are subject to documentary stamp tax. Regardless of where the deed or other document is signed and delivered documentary stamp tax is due. Florida imposes a transfer tax on the transfer of real property in Florida.

But if you do make money from renting or when you sell your property there will be Federal. The transfer tax is a set percentage of either the sale price or the appraised value of the real estate. 011 006 cities within a county that.

0917 sections 196011 and 19626 FS. Most people around the world pay taxes on the transfer of real property. There may be other situations in which the tax does not apply.

In all counties except Miami-Dade County the Florida documentary stamp tax rate is 070 per 100 paid for the. In other words you can calculate the transfer tax in the following way. Regardless of where the deed or other document is signed and delivered documentary stamp tax is due.

Weinstein At 561-745-3040 If You Have Any Questions About Buying Property And Real Estate Tax Laws In Florida. There are some laws that limit the taxes due on owner-occupied homes in Florida. Divide the sales price by 100 then multiply by 70.

According to Section 201021a Florida Statutes Deeds and other documents that transfer an interest in Florida real property are subject to documentary stamp tax. In florida there are two distinct transfer tax rates. Negotiable but usually split both liable if not paid local realty transfer tax.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

How Much Does It Cost To Sell A House Zillow

How To Hide Real Estate Ownership And Own Property Privately

Should I Transfer The Title On My Rental Property To An Llc

What You Should Know About Contra Costa County Transfer Tax

Transfer Tax Who Pays What In Washington Dc

Who Pays What In The Los Angeles County Transfer Tax

What Are Real Estate Transfer Taxes Forbes Advisor

Tax Certificate And Tax Deed Sales Pinellas County Tax

Who Pays What In The Los Angeles County Transfer Tax

Florida Property Tax H R Block

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Texas Real Estate Transfer Taxes An In Depth Guide

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Real Estate Transfer Taxes An In Depth Guide

Florida Real Estate How Much Will It Cost Nmb Florida Realty

Bipartisan Bill Would Cut Realty Transfer Tax By 25 Town Square Delaware Live